Kubo Budget is not just a financial method; it's a lifestyle approach that emphasizes smart spending and saving strategies tailored for individuals and families looking to maximize their financial resources. In this comprehensive guide, we will explore the various aspects of Kubo Budget, how it can help you manage your finances effectively, and the principles that underpin this budgeting method.

Whether you're just starting your financial journey or looking to refine your existing budget, Kubo Budget offers practical tips and strategies that anyone can implement. By understanding your expenses, setting clear financial goals, and making informed decisions, you can achieve a stable financial future without sacrificing your quality of life.

In this article, we will delve deep into the fundamentals of Kubo Budget, providing you with actionable insights and expert advice to help you take control of your finances. From budgeting techniques to investment tips, we've got you covered. So, let's dive in!

Table of Contents

- What is Kubo Budget?

- Importance of Budgeting

- How to Create a Kubo Budget

- Kubo Budgeting Techniques

- Tracking Your Expenses

- Saving and Investing

- Common Budgeting Mistakes

- Conclusion

What is Kubo Budget?

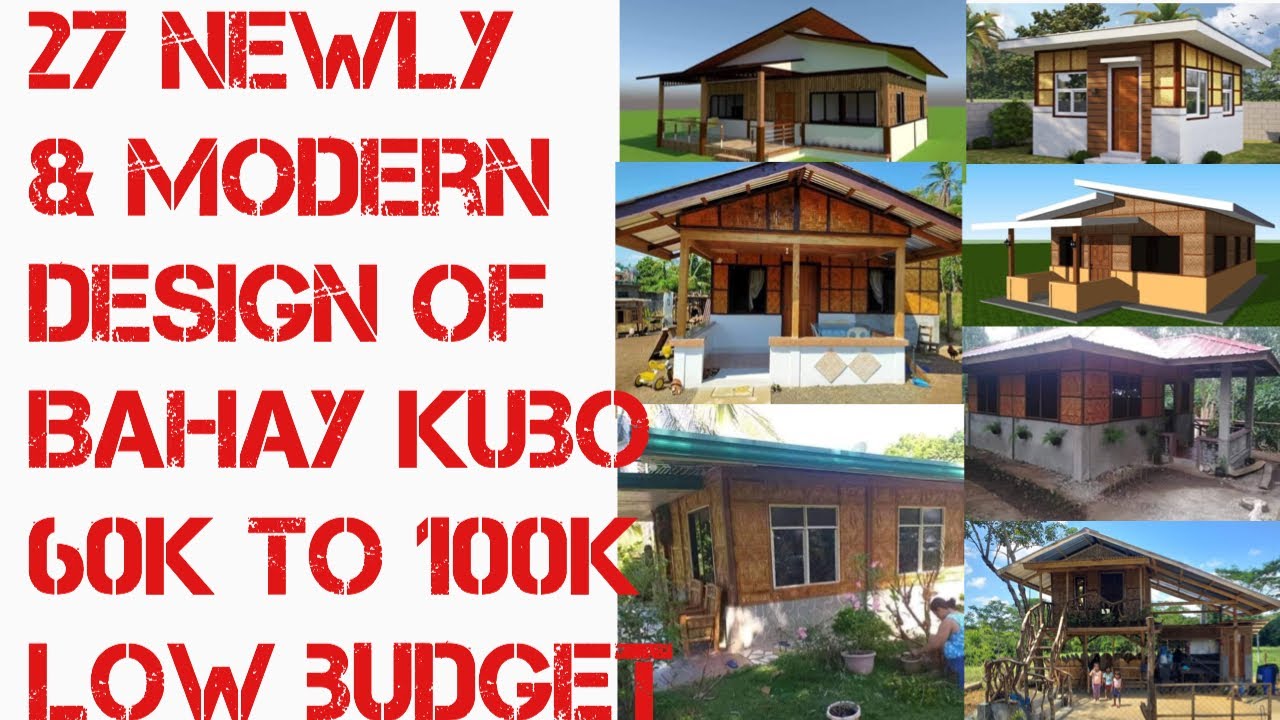

Kubo Budget is a budgeting method that encourages individuals and families to be mindful of their spending and savings. The term "Kubo" is derived from the Filipino word for "hut," symbolizing a simple, sustainable way of living. This budgeting approach focuses on creating a framework that allows for flexibility while ensuring that essential expenses are covered.

Key Principles of Kubo Budget

- Mindful Spending: Understanding where your money goes and making conscious choices.

- Emergency Fund: Setting aside funds for unexpected expenses.

- Goal Setting: Establishing clear financial goals to work towards.

- Continuous Evaluation: Regularly reviewing your budget to make necessary adjustments.

Importance of Budgeting

Budgeting is essential for anyone looking to achieve financial stability. Here are some reasons why having a budget is crucial:

- Control Over Finances: A budget helps you monitor your income and expenses, allowing you to make informed financial decisions.

- Debt Management: By budgeting, you can allocate funds to pay off debts systematically, reducing financial stress.

- Saving for the Future: A budget encourages saving, enabling you to build wealth and prepare for future needs.

- Financial Goals: It provides a clear path to achieving short-term and long-term financial objectives.

How to Create a Kubo Budget

Creating a Kubo Budget involves several steps that can be tailored to your individual financial situation. Here’s a step-by-step guide:

- Assess Your Income: Calculate your total monthly income from all sources.

- List Your Expenses: Document all your fixed and variable expenses.

- Prioritize Needs vs. Wants: Differentiate between essential expenses and discretionary spending.

- Set Financial Goals: Identify short-term and long-term financial objectives.

- Create Your Budget: Allocate your income to cover expenses and savings.

- Review and Adjust: Regularly review your budget and make adjustments as necessary.

Kubo Budgeting Techniques

Implementing effective budgeting techniques can make a significant difference in your financial management. Here are some popular techniques:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings.

- Envelope System: Use cash envelopes for different spending categories to limit overspending.

- Zero-Based Budgeting: Every dollar is assigned a specific purpose, ensuring that your income minus expenses equals zero.

Tracking Your Expenses

Tracking your expenses is crucial for effective budgeting. Here are some methods to consider:

- Mobile Apps: Use budgeting apps to track your spending in real-time.

- Spreadsheets: Create a spreadsheet to log and categorize your expenses.

- Manual Journals: Keep a physical journal to record daily expenses.

Saving and Investing

Once you have established a budget, it’s essential to consider saving and investing strategies. Here are some tips:

- Emergency Fund: Aim to save at least three to six months' worth of living expenses.

- Retirement Accounts: Contribute to retirement accounts such as 401(k) or IRA for long-term savings.

- Diversify Investments: Consider a mix of stocks, bonds, and mutual funds to spread risk.

Common Budgeting Mistakes

Avoiding common budgeting mistakes can help you stay on track. Here are some pitfalls to watch out for:

- Underestimating Expenses: Failing to account for all expenses can lead to budget shortfalls.

- Neglecting Savings: Not prioritizing savings can hinder financial growth.

- Being Too Rigid: A budget should allow for flexibility to accommodate unexpected expenses.

Conclusion

In summary, Kubo Budget is an effective approach to managing your finances by promoting mindful spending and strategic saving. By following the steps outlined in this guide, you can take control of your financial future, set and achieve your goals, and enjoy a more secure lifestyle. We encourage you to implement the Kubo budgeting techniques discussed and start your journey towards financial stability today.

Have you tried Kubo Budgeting? Share your experiences in the comments below, and don’t forget to check out our other articles for more financial tips!

Penutup

Thank you for reading! We hope you found this article on Kubo Budget insightful and helpful. Remember, financial wellness is a journey, and we are here to support you every step of the way. Visit us again for more informative content that can help you achieve your financial goals.

You Might Also Like

Understanding The Life And Legacy Of Shirley Caesar's HusbandPantera Phil: The Journey Of A Legendary Figure In The Music Industry

Geena Davis Net Worth 2024: A Comprehensive Look At Her Wealth And Career

Kathy Reichs Illness: Understanding Her Journey And Resilience

Geoffrey Zakarian: The Culinary Genius Behind Chopped

Article Recommendations

- Jason Luv Yumi Eto Latest Updates News

- Ella Langley And Riley Green Dating Rumors Is It True

- Gruesome Quiero Agua Gore Video Disturbing Footage