Estimating an individual's financial standing can be complex. A comprehensive understanding of wealth requires careful consideration of various factors.

Estimating an individual's financial standing is a complex task, involving analysis of assets, income streams, and debts. It is important to note that such estimations are often based on publicly available information and may not reflect the full picture of an individual's financial status. Publicly reported figures, when available, represent an approximation of that individual's overall net worth.

While the precise financial details of a person may not always be known publicly, understanding the concepts behind calculating net worth and the various factors influencing it, can contribute to broader economic literacy. Knowledge of the wealth of individuals can contribute to discussions about societal and economic trends, particularly when considering the lives and careers of public figures. Analyzing public financial information in the context of these broader discussions is a useful intellectual exercise for understanding economic patterns and societal values.

| Category | Details |

|---|---|

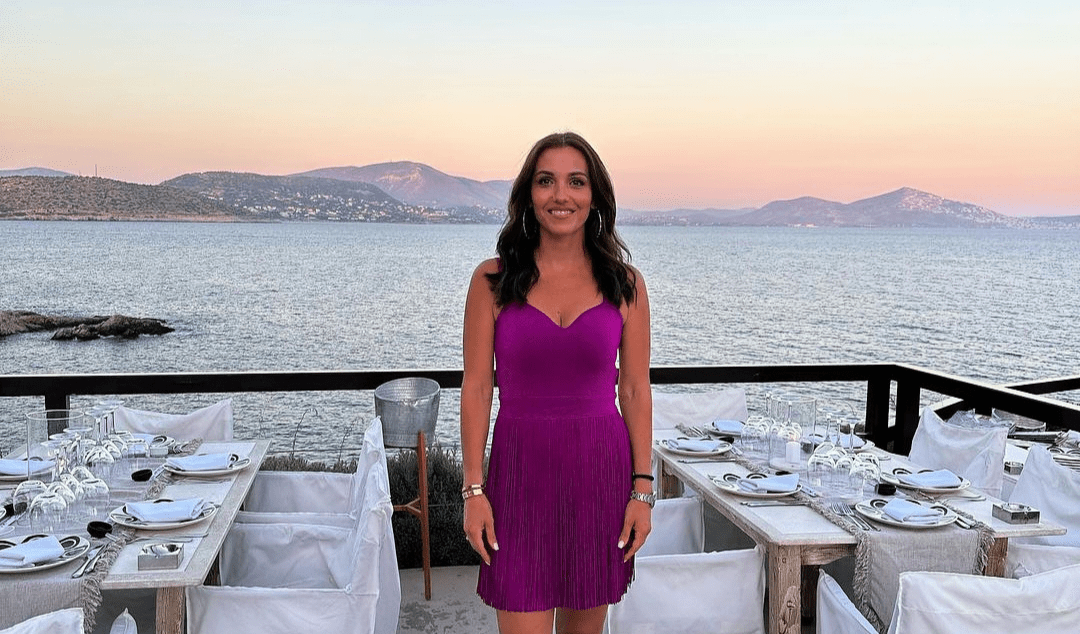

| Name | Stella Drivas |

| Occupation | (To be determined. Information on Stella Drivas and her career is needed.) |

| Source of Information | (Publicly available sources about Stella Drivas are required.) |

To provide a meaningful and accurate discussion on the topic of Stella Drivas's financial situation, further information about her is needed. Details regarding her career, income sources, and assets would allow a more thorough evaluation of her overall financial standing. This will allow us to fully address the question of her financial circumstances in a useful and educational context.

Stella Drivas Net Worth

Determining net worth involves assessing various financial factors. A comprehensive understanding requires examining assets, income, and debts.

- Assets

- Income

- Debts

- Investments

- Expenses

- Valuation

- Public Information

- Transparency

Understanding Stella Drivas's net worth necessitates analyzing her assets, including property, investments, and other holdings. Income sources, whether from employment, ventures, or investments, are key factors. Debts and expenses also influence the calculation. Investment strategies play a significant role. Proper valuation methodologies are critical. Publicly accessible data often provides a partial picture. Ideally, financial transparency provides a clearer understanding. Without this data, a precise estimation of her net worth remains elusive. For example, a celebrity's net worth could include income from endorsements and appearances. Understanding these interconnected facets yields insight into personal finances.

1. Assets

Assets significantly influence an individual's net worth. Assets represent valuable possessions, including tangible items like property and vehicles, and intangible items such as intellectual property or investments. The value of these assets directly impacts the calculation of net worth. A substantial increase in the value of assets positively correlates with a rise in net worth, whereas a decrease in asset value reduces net worth. For example, a significant property increase or successful investment portfolio can substantially elevate an individual's net worth.

The types and values of assets held by an individual significantly contribute to their overall net worth. A diverse portfolio of assets, encompassing various categories like real estate, stocks, bonds, and valuable collections, often signifies a higher net worth. The potential for future growth and the liquidity of assets are further factors. For instance, readily marketable stocks might contribute more liquidity than, say, a vintage car collection. The variability in the nature and value of assets underscores the importance of evaluating diverse assets in assessing someone's total financial standing. This understanding is crucial for evaluating an individual's financial health and stability.

In summary, assets are fundamental components in determining net worth. A comprehensive understanding of the types, values, and liquidity of an individual's assets provides valuable insight into their financial position. However, a single point in time estimation may not reflect fluctuations in asset values or the overall financial picture. Evaluating assets and the factors influencing their value are essential for assessing someone's overall financial position.

2. Income

Income significantly influences an individual's net worth. The amount and sources of income directly impact the accumulation and growth of financial resources. Understanding the nature of income streams is essential for assessing overall financial standing, particularly in the context of an individual's wealth. The stability and predictability of income play a crucial role in the overall financial well-being and security of an individual. This is particularly relevant when considering how consistent and substantial income contributes to accumulating wealth.

- Employment Income

Salaries, wages, and professional fees constitute employment income. The amount of this income directly correlates to the amount of capital an individual can accumulate over time. Consistency in employment income, coupled with effective financial management, generally fosters financial stability and growth in accumulated wealth. For example, a steady salary from a secure job, accompanied by savings and prudent investment strategies, can significantly contribute to a higher net worth.

- Investment Income

Income derived from investments, including dividends, interest, and capital gains, is a crucial component of net worth. The generation of income through investments often signifies a strong financial foundation, contributing to long-term wealth accumulation. Successful investment strategies, with consistent returns, contribute positively to net worth over the long term. Examples include income generated through stocks, bonds, real estate, or other investment vehicles. This income stream can represent a vital component in a person's overall financial profile and should be analyzed alongside other factors.

- Entrepreneurial Income

Income generated from business ventures or entrepreneurial activities varies greatly. The success and profitability of a business are essential to determine the income derived. Profit margins, efficiency, and market position significantly influence the net income generated. The success of ventures or the fluctuating nature of entrepreneurial income can impact and shape an individual's net worth, which can involve considerable risk or volatility. It's important to account for the complexities of such a variable income stream.

- Passive Income

Income generated with minimal ongoing effort, such as rental income or royalties, plays a crucial role in increasing an individual's net worth, especially in the long run. Consistency and growth in passive income streams contribute to financial stability and wealth building. This type of income stream can provide additional security and enhance overall financial freedom. A steady flow of passive income can allow individuals to work less, focus on higher-level aspirations, or accumulate capital.

Evaluating these various income streams is integral to understanding the multifaceted contributions to a person's overall financial standing. A comprehensive analysis of different income sources, considering factors like consistency, risk, and potential for growth, provides a nuanced perspective on how various income streams shape the total wealth accumulated. Understanding the role income plays in building wealth is critical to understanding the broader economic landscape and personal financial success.

3. Debts

Debts directly impact net worth. A substantial level of debt reduces net worth, acting as a counterweight to assets and income. The existence and magnitude of debts significantly influence an individual's financial standing. High levels of outstanding debt can represent a financial strain, potentially hindering the accumulation of wealth. This is especially relevant when evaluating an individual's overall financial health and long-term prospects.

The relationship between debts and net worth is a fundamental one. Debts, in essence, represent a claim against an individual's assets and income. If debts exceed the value of assets, the net worth becomes negative. This situation often signals potential financial instability and difficulties in accumulating future wealth. The importance of managing debts, particularly high-interest debts, becomes evident in this context. For example, a large mortgage or substantial credit card debt can significantly diminish a person's net worth if not carefully managed. Similarly, unpaid or overdue loans will negatively influence the individual's net worth, impacting the overall financial position. This negative effect is more pronounced when considering long-term financial stability and future wealth-building potential.

Recognizing the crucial role of debts in determining net worth is essential. A clear understanding of the relationship between debts and assets provides a comprehensive evaluation of financial well-being. Careful financial planning, effective debt management strategies, and the potential impact of different types of debt on future accumulation are necessary for an informed and balanced perspective. By understanding the effect debts have on net worth, individuals and analysts can assess an individual's financial health and stability with more accuracy, leading to better financial decisions.

4. Investments

Investments play a critical role in determining net worth. The nature and success of investment strategies directly correlate with the growth or decline of an individual's financial standing. Analyzing investment portfolios is essential for evaluating the overall financial health and wealth-building potential. Understanding the types, value, and potential return of investments provides a clearer picture of the factors affecting the individual's financial status, such as Stella Drivas.

- Portfolio Diversification

Diversification of investments across various asset classes, including stocks, bonds, real estate, and alternative investments, is a key element in risk management. A well-diversified portfolio can mitigate potential losses from market fluctuations in specific areas. For example, if stock market performance falters, a portfolio with a significant allocation to bonds or real estate may provide stability and limit the overall impact on the total portfolio's value. Diversification's impact on overall risk and return is particularly important when considering long-term wealth accumulation.

- Investment Timing and Strategy

The timing and strategy behind investment decisions are crucial elements in determining returns. The ability to identify optimal investment opportunities and adapt to changing market conditions is essential for realizing positive returns. Historically successful investment strategies demonstrate how informed decisions and diligent portfolio management contribute significantly to wealth. For instance, consistent investment in low-cost index funds can build long-term wealth. The interplay between timing and strategy influences overall investment performance and can affect the trajectory of someone's net worth.

- Risk Tolerance and Asset Allocation

An individual's risk tolerance profoundly affects investment decisions. Those willing to accept higher risk may pursue investments with greater potential returns but also greater volatility. Conversely, individuals with lower risk tolerance may favor more conservative options. The appropriate allocation of assets within a portfolio aligns with each individual's risk tolerance. The link between risk tolerance, asset allocation, and potential returns significantly influences net worth. For example, a higher allocation to riskier assets, such as stocks, may potentially deliver higher returns but also incur increased volatility.

- Investment Returns and Growth

The returns generated by investments directly affect the growth of net worth. Higher returns from investments translate to increased capital and greater accumulation of wealth. Consistent, above-average returns over time generate substantial wealth gains. Historically high-performing investments have demonstrably increased an individual's net worth. However, it's crucial to note that investment returns aren't guaranteed, and periods of market downturns can negatively impact the value of assets. Understanding the potential for both gains and losses is a crucial aspect of investment evaluation. For instance, the consistent growth in value from a well-managed real estate portfolio can significantly affect someone's financial standing.

In summary, investments are critical factors in shaping and influencing an individual's net worth. Analyzing investment portfolios, including the strategies, risk factors, and returns generated, is essential in assessing the full picture of financial standing. The success and efficacy of investment decisions often reflect the overall financial health and prospects of the individual, like Stella Drivas. Factors such as risk tolerance, diversification strategies, and consistent returns will play an important role in determining net worth.

5. Expenses

Expenses directly influence Stella Drivas's net worth. Understanding the nature and extent of her expenditures provides valuable insight into her financial situation. High expenses, if not offset by adequate income or investments, can diminish accumulated wealth. Conversely, efficient management of expenses can contribute to a greater net worth over time. This exploration examines how different expense categories affect her overall financial standing.

- Living Expenses

Essential costs such as housing, utilities, food, and transportation significantly impact an individual's disposable income. For Stella Drivas, living expenses could encompass luxury accommodations, high-end dining, and premium transportation. Significant variations in these expenses can have a noticeable effect on her net worth, particularly if not balanced by commensurate income. The types and amounts of these expenses provide clues about the lifestyle and financial priorities of Stella Drivas.

- Investment Expenses

Costs associated with investments, such as management fees, commissions, and taxes on investment income, decrease the return on investments. For example, actively managed investment portfolios often require higher fees. These costs can directly diminish net worth over time, so effective portfolio management is crucial. The strategic allocation of resources between expenses and investments significantly influences the growth of net worth.

- Debt Repayment Expenses

Repaying loans, including mortgages, credit card debt, and other personal loans, necessitates a substantial portion of income. The level and type of debt influence net worth; high-interest debt can decrease overall financial health and sustainability. Debt repayment expenses directly reduce funds available for other investments or savings, affecting the rate of net worth growth. Strategies to reduce debt and associated interest costs can significantly improve long-term financial health and net worth.

- Entertainment and Leisure Expenses

Expenditures on entertainment and leisure activities impact disposable income. The amount and frequency of these expenses can substantially influence the accumulation of net worth. The balance between leisure activities and wealth-building endeavors is crucial in maintaining a positive net worth trajectory. An individual's spending habits on these items are revealing of their lifestyle choices and financial priorities.

In conclusion, expenses play a critical role in shaping Stella Drivas's net worth. Careful consideration of expenses, coupled with informed financial decision-making, is vital in optimizing the accumulation of wealth. A detailed examination of expense patterns, in combination with her income sources and investment strategies, provides a clearer understanding of her overall financial situation. This analysis contributes to a complete picture of the factors influencing her net worth.

6. Valuation

Accurate valuation is fundamental to determining Stella Drivas's net worth. Valuation involves establishing the monetary worth of assets. This process is crucial because different assets have different methods of valuation, and errors in valuation can lead to inaccurate assessments of net worth. For instance, a piece of real estate might be valued using comparable sales in the area, while a portfolio of stocks needs a more complex valuation method that considers market prices and potential future earnings. In the case of Stella Drivas, if a significant portion of her assets is in publicly traded stocks, a stock market valuation analysis is essential. If there are privately held assets, such as real estate holdings or other investments not traded on public markets, expert appraisals are needed. These valuations, if not done rigorously, could skew the overall perception of her net worth and ultimately shape any understanding derived from it.

The accuracy and objectivity of valuation methods directly affect the reliability of net worth estimations. Inaccurate or biased valuations can lead to a flawed understanding of financial standing. This is particularly relevant when considering public perceptions of wealth and its influence on various aspects of public life. For example, inaccurate or incomplete valuations of assets in a high-profile individual's portfolio could influence investment decisions, perceptions of financial success, or even potential tax assessments. Understanding the complexity of valuation methods underscores the need for professionals and rigorous approaches to arrive at an accurate, reliable, and credible evaluation. The varied complexities and nuance of the valuation processes emphasize the need for expert evaluation in cases like that of Stella Drivas.

In conclusion, valuation is an indispensable element in determining Stella Drivas's net worth. The methods used and the expertise of the valuers significantly impact the accuracy of the resulting figure. Reliable valuation ensures a clear understanding of her financial standing, influencing economic analyses and perceptions related to her. Without accurate valuation, a meaningful assessment of her net worth remains elusive, and related discussions can be significantly compromised. This highlights the critical role valuation plays in forming informed conclusions about Stella Drivas's financial situation. Precise valuations pave the way for objective interpretations and sound judgments related to Stella Drivas's financial life.

7. Public Information

Publicly available information plays a significant role in estimating an individual's net worth, such as Stella Drivas. This information, often gleaned from publicly accessible sources, forms a cornerstone for estimations, though it represents only a partial picture. News articles, financial reports, and other publicly released data offer insights into income, assets, and potential liabilities. For instance, if Stella Drivas has been involved in high-profile business deals, news reports might disclose details pertaining to the value of her assets. However, publicly accessible data alone does not guarantee a comprehensive understanding. Complex financial arrangements, private investments, and personal assets not subject to public scrutiny may remain undisclosed.

The importance of public information in approximating net worth stems from its accessibility and potential to provide a framework for analysis. However, limitations inherent in such information should be acknowledged. Reliable estimations require supplementing public data with other credible sources and detailed financial analyses. Furthermore, the availability and reliability of public data vary considerably. In some cases, the information might be incomplete, outdated, or even deliberately misleading. Consequently, relying solely on public information to determine precise net worth figures would be an oversimplification and may result in inaccurate conclusions. This understanding is critical for maintaining a balanced perspective in assessing an individual's financial status.

In conclusion, public information serves as a valuable starting point in estimating an individual's net worth like Stella Drivas, but it is essential to consider its limitations and supplement it with other data sources. A comprehensive evaluation requires an awareness of the potential biases and incompleteness of publicly available information. The practical implications for understanding public figures' financial situations necessitate careful consideration of the limitations of accessible data and the need for a more thorough investigative approach.

8. Transparency

Transparency in financial matters is crucial for a comprehensive understanding of an individual's net worth. When discussing figures like Stella Drivas's, open disclosure of financial details, if available, is essential for informed public perception. Without transparency, any estimations of net worth are inherently incomplete, potentially susceptible to misinterpretations. Accurate assessments require verifiable information, allowing for a more nuanced understanding of the financial picture.

- Public Disclosure of Earnings and Assets

Public disclosure of income sources and assets, when available, contributes significantly to transparency. This allows for a verifiable basis for assessing the sources of wealth and the potential impact of various factors on an individual's financial position. Detailed financial reports, if publicly accessible, provide insights into revenue streams, investment activities, and expenditure patterns, assisting in evaluating the overall picture of wealth accumulation or management. This contrasts sharply with situations lacking such disclosures, where assumptions and estimations would be less reliable and often less accurate.

- Independent Verification and Audits

Independent verification, such as financial audits, can significantly bolster transparency. Audits provide a degree of certainty about the accuracy of financial reporting. This process allows for a more rigorous assessment of an individual's assets, income, and liabilities, leading to greater confidence in estimates of net worth. The absence of such verification methods introduces inherent uncertainty and can limit the objectivity of any conclusions drawn about an individual's financial status. For instance, if audits are lacking or unavailable, the public must rely on potentially incomplete or biased information.

- Impact on Public Perception

Transparency directly affects public perception. Open disclosure fosters trust and allows for a more informed public discourse about the individual and their financial standing. A lack of transparency can lead to speculation, misinterpretations, and unfounded assumptions, potentially creating a distorted narrative. For instance, if financial data is not openly available, public perception may be influenced by rumors or conjecture, creating an environment of uncertainty about the true extent of financial resources.

- Relationship to Wealth Management Practices

Transparent financial practices often correlate with sound wealth management strategies. Individuals or entities adhering to transparency in their financial dealings generally exhibit a commitment to accountability and responsibility. This commitment, in turn, can be a sign of a well-structured approach to managing finances. The reverse is also true; a lack of transparency can raise questions about the prudence or ethical aspects of wealth management.

In conclusion, transparency is a critical element when discussing the net worth of any individual, including Stella Drivas. Its absence casts doubt on the completeness and accuracy of any estimations. Public disclosure, independent verification, and the impact on public perception are all crucial facets in understanding how transparency relates to this concept. Ultimately, transparency fosters a more informed and reliable understanding of wealth accumulation and management practices. The absence of transparency, on the other hand, may create a space for speculation, misinterpretations, and less trustworthy estimations of net worth.

Frequently Asked Questions about Stella Drivas's Net Worth

This section addresses common inquiries regarding Stella Drivas's financial status. These questions aim to clarify misconceptions and provide accurate information based on available data.

Question 1: What is Stella Drivas's net worth?

A precise figure for Stella Drivas's net worth is currently unavailable. Estimating net worth requires detailed information about assets, income, and liabilities, which is not always publicly available. Accurate estimations often necessitate comprehensive financial analysis by qualified professionals. Without such data, any stated figure represents an approximation, not a definitive value.

Question 2: Where can I find reliable information about Stella Drivas's financial situation?

Reliable information regarding an individual's financial standing is often found in publicly accessible financial reports, news articles, or legal documents. However, the accuracy and completeness of this data require critical evaluation. A lack of transparency or limited data availability can hinder the creation of definitive conclusions. For instance, data from publicly filed corporate reports or financial filings might contain relevant information but are not necessarily comprehensive.

Question 3: Why is precise information about Stella Drivas's net worth often not available?

Several factors can contribute to the lack of precise net worth information. Privacy considerations, complex financial structures, and the nature of some assets (like privately held companies or intellectual property) may make comprehensive details unavailable to the public. Limited disclosure practices often contribute to the lack of definitive information regarding someone's financial status, such as Stella Drivas's.

Question 4: How do public figures' financial details affect public perception?

The availability of public figures' financial information can impact perceptions of their success and influence. This information can also affect investment decisions, particularly when dealing with publicly traded assets. Discussions of wealth and associated factors can raise implications related to societal values and economic principles. However, it's important to acknowledge that such information may not be a complete picture and shouldn't be the sole basis for comprehensive evaluations of an individual's influence or accomplishments.

Question 5: How can I stay informed about Stella Drivas's public activities and potentially related financial news?

Staying informed requires monitoring reputable news sources and financial publications for details regarding Stella Drivas and related topics. Careful attention to the context surrounding reported information, and an awareness of the sources of information, is critical for a complete understanding of the situation.

In conclusion, a comprehensive understanding of Stella Drivas's financial standing necessitates access to thorough and verifiable information. Relying solely on estimations or incomplete data can lead to inaccurate interpretations. It's crucial to approach such discussions with critical analysis and a nuanced perspective, avoiding potentially misleading information.

Moving forward, this article will explore the broader implications of public perception of wealth.

Conclusion

Determining Stella Drivas's net worth necessitates a comprehensive analysis encompassing various factors. This includes assessing assets, income sources, and liabilities. Publicly available data, while providing a starting point, often represents only a partial picture. The complexities of valuation, particularly regarding privately held assets, introduce inherent limitations to precise estimations. Expense patterns, investment strategies, and debt levels all contribute to the overall financial picture, which is often subject to change. Understanding the intricacies of these elements is essential for forming a balanced perspective on Stella Drivas's financial situation.

This exploration emphasizes the importance of critical evaluation when examining an individual's financial standing. A balanced approach demands a meticulous assessment of publicly available information, coupled with an acknowledgement of potential limitations and the need for additional credible sources. Furthermore, the complexities highlight the significance of financial transparency in enabling a complete and objective understanding of wealth accumulation and management practices. Future analysis of such matters should prioritize meticulous research, acknowledging the limitations of public information, and seeking comprehensive data whenever possible.

You Might Also Like

Gerard Butler Net Worth 2023: A Deep DiveHeavy D Net Worth 2024: Latest Estimates & Details

Thomas Ravenel: In Jail? Details & Updates

Did Eazy-E's Wife Get AIDS? Truth About Illness

KERRION FRANKLIN NET WORTH 2024: Full Breakdown

Article Recommendations

- Gruesome Quiero Agua Gore Video Disturbing Footage

- Jason Luv Yumi Eto Latest Updates News

- Ella Langley And Riley Green Dating Rumors Is It True